Peak Oil

- EIA report June 10, 2025, this updated their April warning of US Peak Fracking in 2027 and “Production to fall rapidly from 2030 through 2050“

- OilPrice.com: EIA Calls Peak Shale as Drilling Activity Declines

- Bloomberg: Shale Drillers in Permian Basin Face Up to the Prospect of Peak Output

- Forbes: Peak Oil In America: ‘Drill, Baby, Drill’ May Be Hitting A Wall

- Wall Street Journal: U.S. Drillers Say Peak Shale Has Arrived

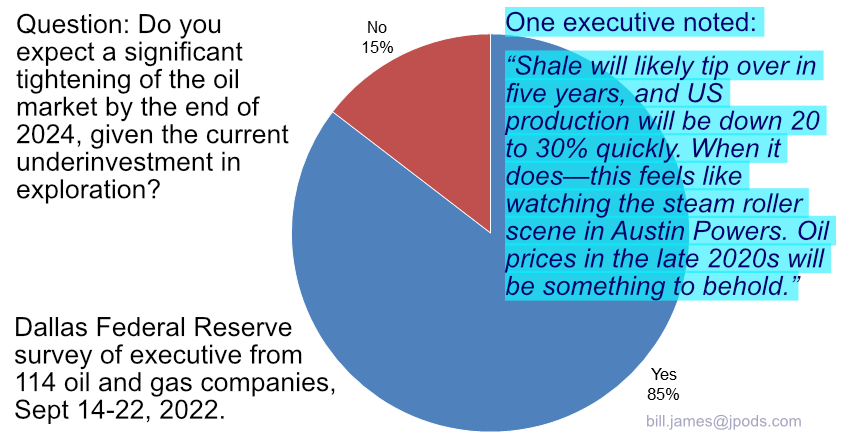

- Dallas Federal Reserve survey of oil companies cited comment: “Shale core exhaustion and inventory concerns are mainstream and well-documented issues. Shale will likely tip over in five years, and U.S. production will be down 20 to 30 percent quickly. When it does—this feels like watching the steam roller scene in Austin Powers. Oil prices in the late 2020s will be something to behold.”

- In 1970 US oil production was 10,044 tb/d (thousand barrels per day) to support 203 million lives – 49.5 tb/d/million people.

- Last reported production was 13,400 tb/d. Not reported is the need to support 340.1 million Americans – 39.4 th/d/million people. A decrease of energy of 20% per life.

The end of affordable oil has been known for a century:

Thomas Edison, 1931: “I’d put my money on the sun and solar energy. What a source of power! I hope we don’t have to wait ’til oil and coal run out before we tackle that.”

Admiral Rickover, 1957 Energy Slave speech: “For it is an unpleasant fact that according to our best estimates, total fossil fuel reserves recoverable at not over twice today’s unit cost, are likely to run out at some time between the years 2000 and 2050”

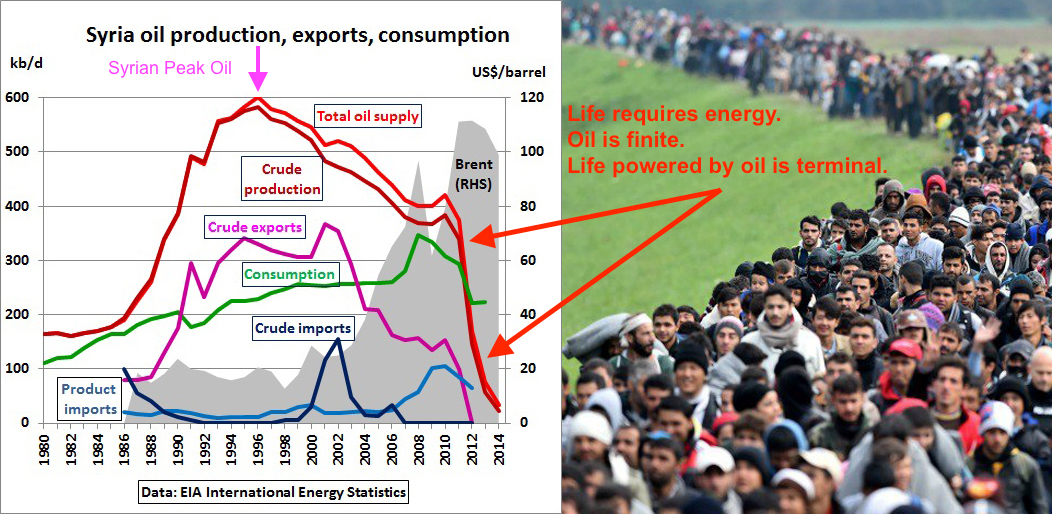

Life requires energy. Oil is finite. Life powered by cheap oil is terminal. Without immediate and decisive action the 2008 crisis of unaffordable gasoline collapsing the banking system will replay in the 2020s.

Rig Count and DUCs (Drilled UnCompleted wells) today determine the supply of 3-10 years in the future). Affordable oil in 2023 is the result of 1,500 Rig Count between 2010 and 2014. The current Rig Count is 669 (2023-07-23) and falling.

Rig Count and DUCs (Drilled UnCompleted wells) today determine the supply of 3-10 years in the future). Affordable oil in 2023 is the result of 1,500 Rig Count between 2010 and 2014. The current Rig Count is 669 (2023-07-23) and falling.- Oil is a $2.1 trillion/year market that will soon be unaffordable.

- Foreign oil addiction resulted with the last ten US Presidents issuing unanswered calls to action to cut US oil use by 1/3rd, to end foreign oil addiction. Soldiers have been buying time to answer these calls in oil-wars since 1991.

- In 2008 the banking system, and nearly the economy collapsed as US oil production decreased since 1970.

- 2024, “Drill, Baby, Drill” Failed in Trump’s First Term

- 2022, Sept, the Dallas Fed oil supply surveyed 153 oil companies on the supply of oil in 2024. Link to background data Energy Central or Seeking Alpha

- Question: Do you expect a significant tightening of the oil market by the end of 2024, given the current underinvestment in exploration?

- Answer: 85% agree.

- Cited comment: “Shale core exhaustion and inventory concerns are mainstream and well-documented issues. Shale will likely tip over in five years, and U.S. production will be down 20 to 30 percent quickly. When it does—this feels like watching the steam roller scene in Austin Powers. Oil prices in the late 2020s will be something to behold.”

- “underinvestment” can be measured by Rig Count. The Rig Count of 1,500 between 2010-2014 created the

affordable supply of oil between 2012-2023. Rig Count in Aug 2023 is 642.

affordable supply of oil between 2012-2023. Rig Count in Aug 2023 is 642. - Question: Do you expect the age of inexpensive U.S. natural gas to come to an end as liquefied natural gas exports to Europe expand?

- Answer: 69% agree.

- Cited comment:“As to the question regarding natural gas, the age of inexpensive gas has already ended.”

- Link to steam roller scene in Austin Powers, geology is slow moving and massive.

- Admiral Rickover, 1957 Energy Slave speech: “For it is an unpleasant fact that according to our best estimates, total fossil fuel reserves recoverable at not over twice today’s unit cost, are likely to run out at some time between the years 2000 and 2050”

- President Obama, 2010: “For decades we have known that the days of cheap and easily accessible oil were numbered….” Link to President Obama and 9 other Presidents issuing unanswered calls to action to cut US oil consumption by at least 1/3rd.

- I think historians looking back on this event will name it Oil Famine. Life requires energy, without greater efficiency, less energy mandates less life.

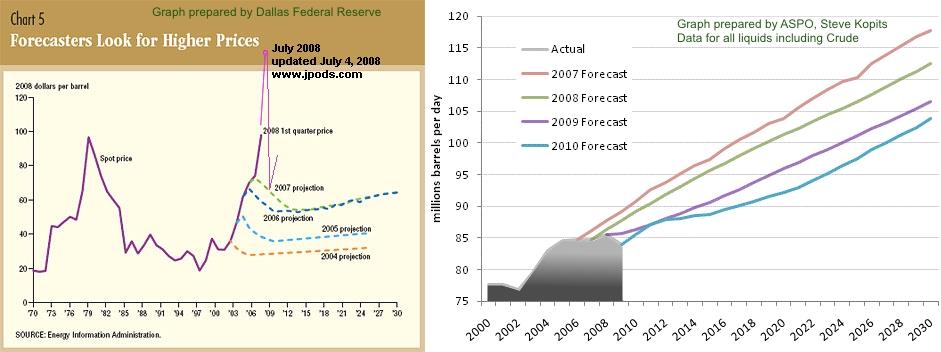

- 2008, May, Dallas Fed: Crude Awakening: Behind the Surge in Oil Prices

- 2010-2020, the Fracking Boom provided affordable oil while losing $300 billion with many bankruptcies in 2019 and 2020.

- 2013, Jul, Dallas Fed: Bottom-line Cost of 2007–09 Financial Crisis Estimated at $6 Trillion to $14 Trillion

- 2013, Sep, Dallas Fed: Assessing the Costs and Consequences of the 2007–09 Financial Crisis and Its Aftermath.

Resources to understand the coming Oil Famine:

- Dr. Hubbert’s 1956 presentation of US Peak Oil by 1970.

- Admiral Rickover’s 1957 speech on “energy slaves”. Illicit Energy is dependence on energy outside self-reliance. Federal support for foreign oil exactly repeats the path to war of Federal support for slavery. (link)

- 2005 ABC-Australia documentary on Peak Oil (taken off line several years ago. Hopefully access will be restored.)

- Crude: The Incredible Journey Of Oil

- Crash Course, Energy Economics, Cheap Peak Oil, Shale Oil, parts of the Crash Course by Chris Martinson

- Eight Presidents declaring oil addiction a threat to national security. Proved by oil-dollar funded terrorism and oil-wars.

- Five Presidential veto messages of why Federal oil-powered infrastructure is unconstitutional (Madison, Monroe, Jackson, Polk, and Buchanan).

- Fracking accounts for 65% of US oil production in 2016. Fracking production depletions. Fracking forecasts are unrealistic.

- Summary of consequences of Russia-Ukraine War.

- Changing World Order by Ray Dalio.

- China rapidly reducing oil addiction, Oil Is Going To Crash By The End Of The Decade. As renewable replace oil, there is a risk oil supply chains built for volume will collapse more rapidly that renewables can replace them.

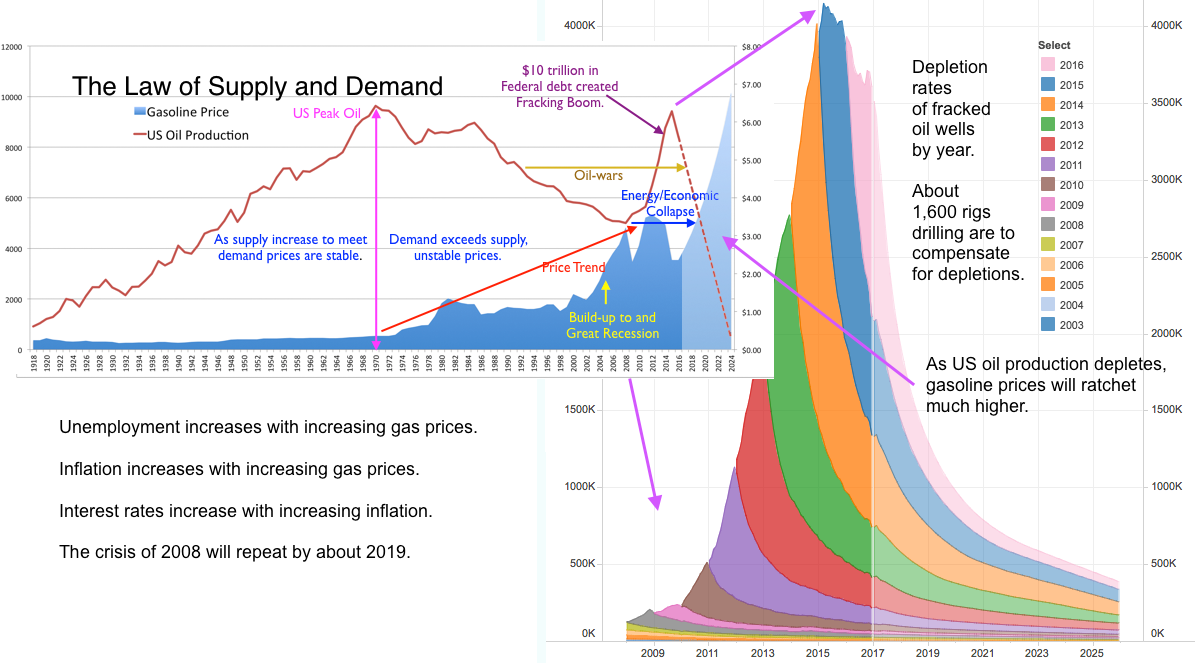

Geology is slow and relentless. US Peak Oil was in 1970. Until US Peak Oil, the price of gasoline was stable

Regardless of our wishes. Life requires energy. Oil is finite. The unconstitutional Federal highway monopoly binds the survival of American to oil. This oil addiction is terminal, by about 2019.

Fracking is desperation, not a solution.

source: tradingeconomics.com

“Extraordinary advances in technology have transformed energy exploration and production. Yet we produce 39 percent less oil today than we did in 1970, leaving us ever more reliant on foreign suppliers. On our present course, America 20 years from now will import nearly two of every three barrels of oil–a condition of increased dependency on foreign powers that do not always have America’s interests at heart.”

May 16, 2001: National Energy Policy: Report of the National Energy Policy Development Group established by President Bush, Chairman Vice President Chaney

US Peak Oil was in 1970. Life requires energy. Oil is finite. Life and nations powered by oil are terminal. Near collapse in 2008 will replay before 2030 according to the Dallas Federal Reserve survey of oil companies. The US hit Peak Fracking in 2025, EIA.

Peak Oil is not about a lack of oil; there is a lot of oil left in America. Peak Oil is the economic event when the cost to extract oil exceeds the price people afford to buy gasoline made from it. A Rig Count of about 1,600 was required to create the Fracking Boom. With the bankruptcies, rig counts dropped below 500. In July 2017 the Rig Count is at 958 (link to Rig Count).

Fracking is “Running with the Red Queen“, you have to keep running faster and faster just to remain in the same place. Link to graph source. These older graphs show the direction of the crisis that is unfolding at a geological pace. Likely replay of 2008 crisis is before 2030.

The Law of Supply and Demand:

Fracking:

- History of US oil imports (Ref: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=wceimus2&f=4)

- After Blowing $300 Billion, U.S. Shale Finally Makes Money The red area is where the industry was going bankrupt to deliver oil.

- US shale oil: can a leaner industry ever lure back investors?

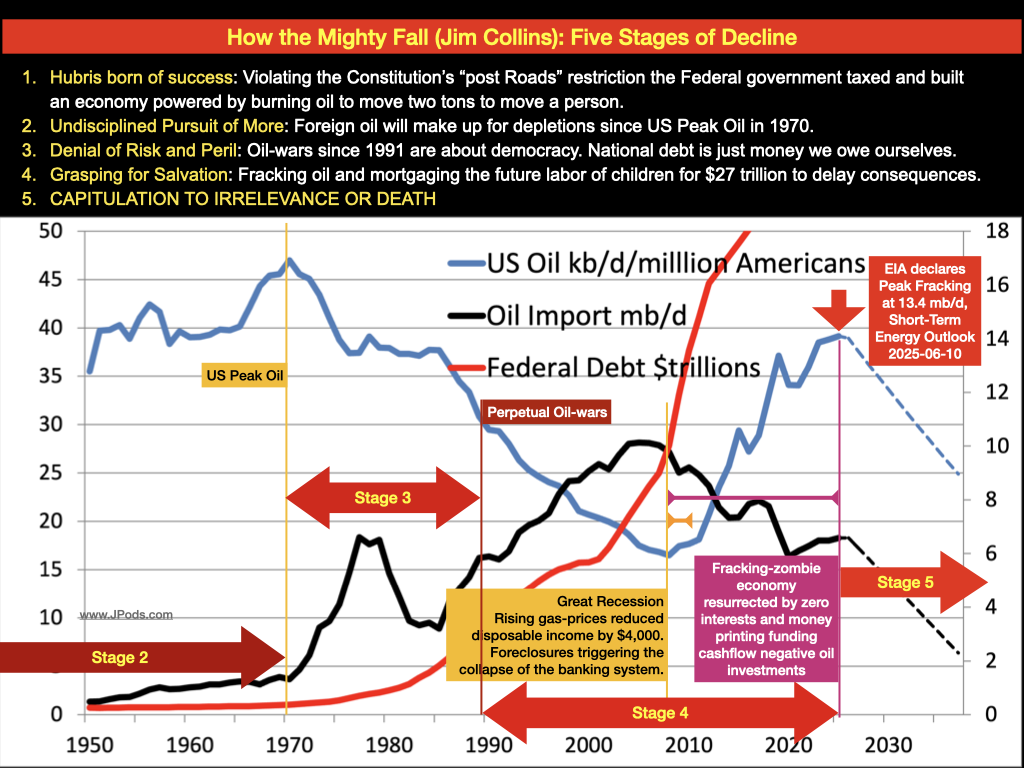

Between 1970 and 2008 depleting US oil production created four trends that shape America’s present:

- Transfer of wealth from the US to the Middle East. As US oil production decreased the Federal government borrowed $18 trillion against the future labor of America’s children to buy and defend access to foreign oil to power its unconstitutional highway monopoly (see Illicit Energy, Divided Sovereignty and Internal Improvements). Vast cities were built in the Middle East on this wealth.

- Funding of enemies with oil-dollars. Part of this transfer of wealth to the Middle East funded radical regimes and terrorism.

- Oil-wars and occupation of the Middle East since 1991 to secure access to foreign oil. With occupation, terrorists had a visible emblem to rally people to their cause with US oil-dollars suppling the money.

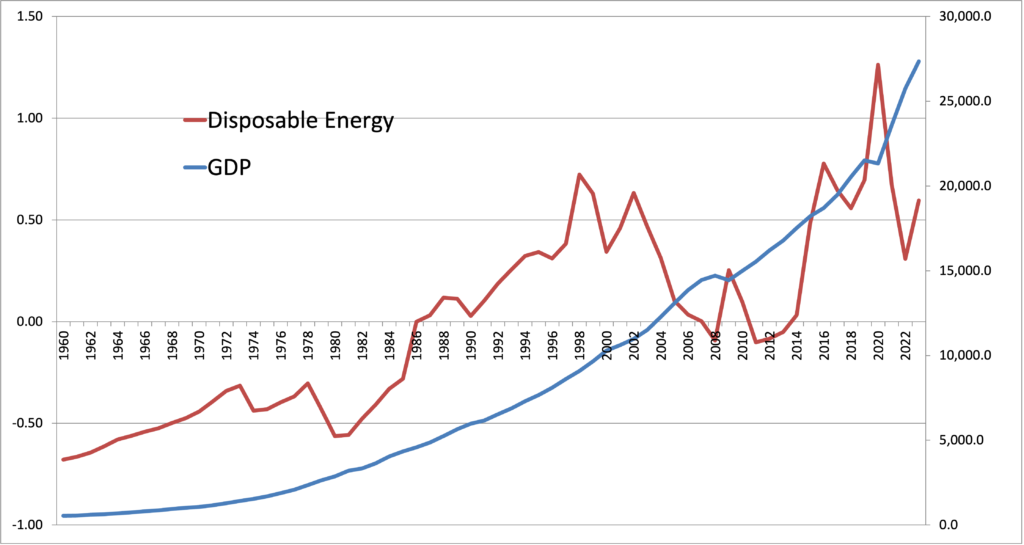

- Rising gasoline prices between 1998 and 2008. US families lost between $2,000 and $4,155 in disposable income (see metric of Disposable Energy). Incrementally families used their mortage payments to buy gasoline to fund their commute and keep their jobs.

In September 2008 debt and foreclosures nearly world economy. Instead of solving the problem by exercising the self-discipline to become energy self-reliant, the Federal “bailout” borrowed an additional $6 and $14 trillion. The zero interest rates caused $200 billion to be invested in Fracking. Frackers, deploying 2,000 drilling rigs for years, used this investment to increase US Oil produciton by 5 million barrels per day (mb/d). When Saudi Arabia did not cut it production to match the US increase, oil prices dropped, Frackers went bankrupt and the number of drilling rigs dropped to 400.

Fracking and recession bought time. US Peak Fracking was in June 2015. Since Peak Fracking, US oil production has been decreasing at 1 million barrels per day (mb/d) per year. This is the equivalent of one 1973 Oil Embargo. This rate of decline will continue for at least 3 more year. Before 2020, decreasing US oil production and increasing dependence on foreign oil will repeat the crisis of 2008. Life requires energy. Oil is finite. Life powered by oil is terminal.

Logistics have mass and momentum. Like watching two ship on a collision, the crisis resulting from momentum is created long before the actual impact. Will experience a crisis exceeding 2008 by 2020 based on logistical momentum. We cannot avoid the crisis. We can mitigate the harm.

1. Actions:

- Plant Victory Garden. Energy self-reliance starts with the self. If every America grows 1/3rd of their own food, the coming oil supply shock will be hard, but not a famine.

- Exercising self-discipline to be energy self-reliant is the solution.

- Defend the Constitution and our children, is to defend Liberty for Posterity. The Earth Belongs to the Living.

- End Tyranny of the Majority

- End Illicit Energy, dependence on energy outside self-reliance. Federal support for dependence on foreign oil repeats the Path to War of Federal support for slavery.

- Restore transport infrastructure to free markets via the Performance Standards Law.

- Capitalize pollution and resource depletion costs into the price of using fossil fuels.

- Restore power generation to free markets with Feed-in-Tarriffs. Rates set based on pollution not created (point above and value of energy durability).

- Leverage two paradoxes:

- The Stockdale Paradox: Unwavering faith that we will prevail while facing the most brutal facts of our current reality.

- The Lifeboat Paradox: Being self-disciplined to have and be skilled in the use of a lifeboat, reduces the need for a lifeboat.

Surprisingly, it is 10x, ten times cheaper to be energy self-reliant. It is both very expensive and wasteful to move a ton to move a person.

2. The brutal facts:

- The nature of Peak Oil has been known since 1956.

- The Federal-Aid Highway Act of 1956:

- Removed energy efficiency as a market force.

- Caused the loss of nearly half (120,000 miles) of freight railroads. Freight railroads average 476 ton-miles per gallon.

- Subordinated the survival of America to a foreign power, a 50% dependence on imported oil.

- Caused national debt to increase in tandem with oil imports.

- Stifled innovations such as Morgantown PRT network.

- Admiral Rickover warned of the perpetual oil wars since 1991 in 1957.

- Peak Oil Discovery was in 1964.

- US Peak Oil was in 1970. Peak Prudhoe Bay in 1985. Peak Fracking was in 2025.

- American soldier have traded blood since 1991 to buy Americans time to exercise self-discipline to become independent of foreign oil.

- Americans have lacked the self-discipline to be energy self-reliant until Oil Famine looms by 2020.

- Our economy is based on five assumptions that are no longer valid:

- Volume: Oil availabiity expanding faster than demand.

- Price: Oil priced at $30 a barrel, gas at $1.45 a gallon.

- Quality: Net Energy of 20:1, 20 barrels available for every barrel used to get more oil.

- Growth: Oil supply will grow to support economic growth.

- Debt: What we cannot afford to pay for, we can borrow from the future.

- Our economy is based on five assumptions that are no longer valid:

- The Law of Supply and Demand requires prices to rise as supply diminish.

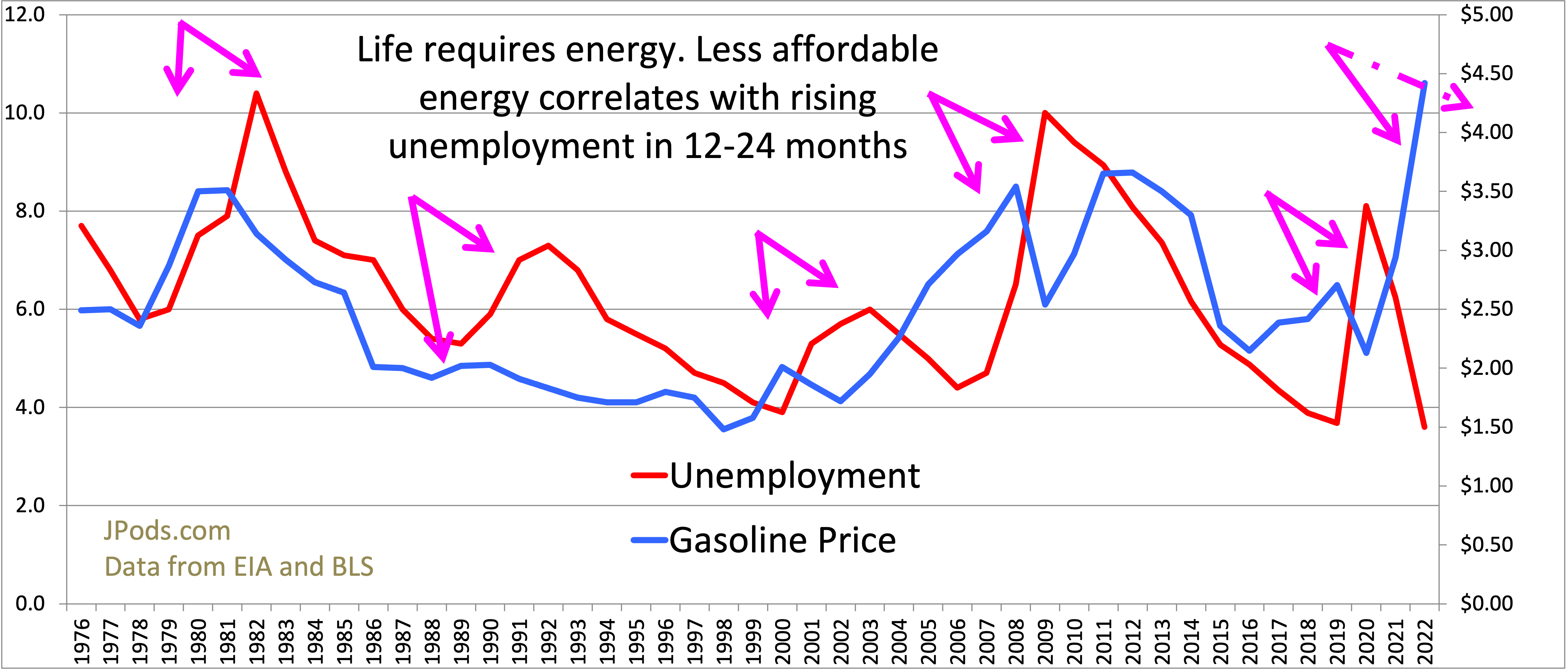

- Gasoline prices are highly correlated to unemployment two years earlier.

- Peak Fracking was in June 2015.

- Frackers are:

- Since zero interest rates in 2008 obtained $200 billion to invest in putting 2,000 drilling rigs into the field and nearly doubled US oil Production by 2015.

- Caused prices to fall. When Saudi Arabia did not cut production to match US increases, oil prices fell. Behind on bond payments, Frackers pumped faster so volume could compensate for low prices.

- $200 billion in debt selling $billion in assets.

- Spending 86% of their operating profits on debt trying to mitigate bankruptcy.

- Laying off their crews.

- Fracked wells deplete very fast.

- Rig counts have fallen from 2,000 to 400.

- Depletions are progressing at one million barrels per day (mb/d) per year. Link to EIA US Oil Production chart.

- EIA is completely incompetent in their duty to warn the American people of energy risks:

- Link to EIA US Oil Production forecast.

- April 2016 discounting Peak Fracking

- May 2016 incredible forecast of US net energy exports by 2030.

- Dallas Federal Reserve:

- Sept 2022: 85% of oil executives survey agree “underinvestment in exploration” will result in “tightening the oil market by the end of 2024”

- Jul 2013: Bottom-line Cost of 2007–09 Financial Crisis Estimated at $6 Trillion to $14 Trillion and Sep, 2013: Assessing the Costs and Consequences of the 2007–09 Financial Crisis and Its Aftermath.

- May 2008: Graph by the Dallas Federal Reserve and ASPO on similar EIA forecasting failures approaching the 2008 crisis:

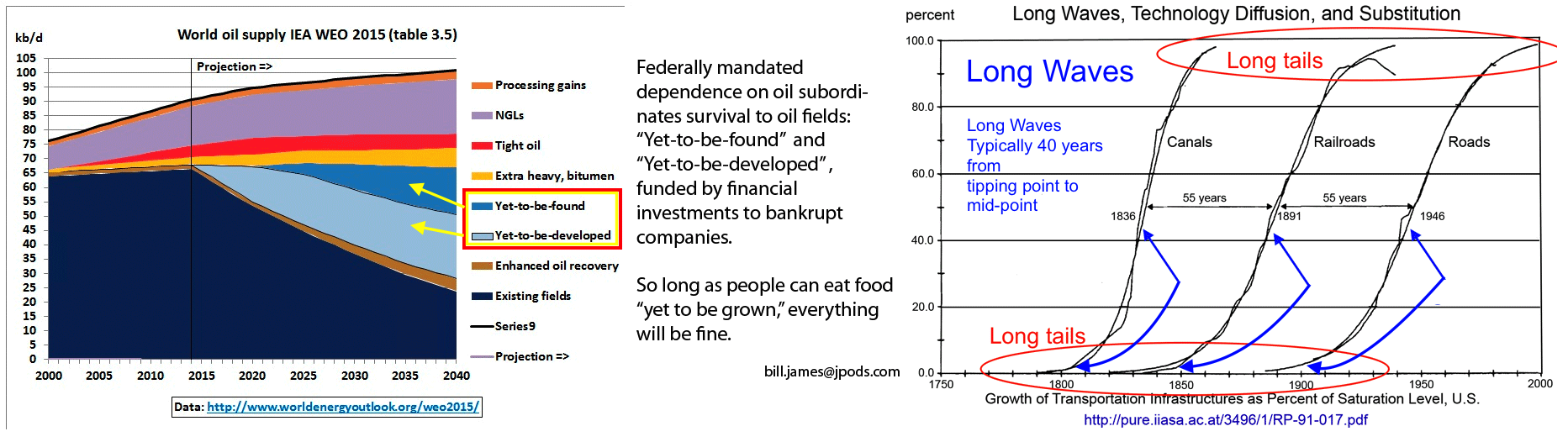

- EIA failes to warn that it normally requires 40 to 200 years to retool a major infrastructure while it sister agency, IEA notes that production will meet needs based on “Fields Yet-to-be-found” and “Yet-to-be-developed”. They also ignor that this “Yet to be” oil, requires $billions in capital investment into Exploration and Production (E&P) companies that are currently in bankruptcy.

3. Understanding oil geology is straightforward:

ABC Australia 2005 documentary with excellent interviews. |

4. Oil Famine:

The near collapse of the US economy in Sept 2008 was the last warning of the coming Oil Famine.

The 2008-2015 situation in Syria illustrates what happens as cheap oil expands a country’s population and revenues. Then oil production peaks, domestic consumption exceeds production, governments and populations crash into a Mad Max consequence we see with ISIS.

The Syrian situation has been unfolding in the world since 1979. Per Capita energy peaked in 1979. Setting in motion a Mathusian collapse of the economy known as the Olduvai Gorge Theory. Our monolithic dependence on oil is similar to the Ireland’s 1840 dependence on a single potato strain.

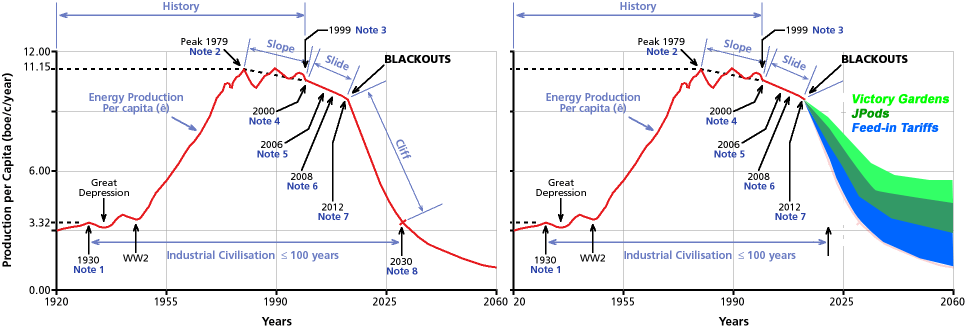

We have a choice, illustrated in the following two graphs:

- Left Graph: 80-90% die-off and a post-industrial agrarian world.

- Right Graph: Re-tool infrastructure for transportation, power generation and food production. Change the lifeblood of our economy from oil to ingenuity. Repeat the successful re-tooling of communications infrastructure, allow personal responsibility, free markets and small businesses to innovate:

- Victory Gardens – personal responsibility for self-reliance.

- JPods and other Performance Standards transportation systems to increase efficiency 10 to 100 times.

- Feed-in Tariffs – allowing small businesses to generate and sell electricity to increase efficiency 10 to 100 times.

5. Saudi Arabia and China are adjusting:

Saudi Arabia to run out of cash in less than 5 years. Saudi Arabia May Become Oil Importer by 2030, Citigroup Says (note CitiGroups largest shareholder is from Saudi Arabia).

Saudi Arabia announced a $2 trillion “Post-oil Era” fund to move their economy off oil as they face Peak Oil.

6. Other:

Disposable Energy should replace GDP as a metric of government performance on the economy.

US poverty levels are climbing.

It is vital to convert the base of our transportation economy from oil to ingenuity. Before the economy slows to far, it is critical to understand that Demand Destruction equates to Economic Destruction

Jeff Rubin, Chief Economist at CIBC World Markets, recently reported on this decay of economic momentum:

Four of the last five global recessions were caused by huge spikes in oil prices and the world economy is coming off the mother of all spikes. Over the past expansion, real oil prices rose over 500%, twice the climb in real oil prices that produced the two biggest recessions in the post-war era: the 1974 recession and the double-dip recession in 1980 and 1982. If oil shocks half the size of the recent one caused the worst recessions in the last fifty years, they’re a pretty obvious explanation for the recessions in oil-dependent Japan and Euroland earlier in the year. From where the US economy currently stands, vehicle sales have a much bigger downside than housing starts.

Most of the world’s major economies are importers. World Oil Exports measure energy available to drive economies

Available Exports, Worse than 1973 Oil Embargo

We have known this would happen for half a century, but central planning and subsidies distorted people’s perception and how we cause markets to adapt. Aware of daily feedings, the turkey is comfortably unaware of Thanksgiving; people are unaware Peak Oil. Unstable oil prices were our last warning. Oil will be back to $100 by summer. By 2012 our third largest supplier, Mexico will deplete below their domestic consumption. Mexico’s fields are depleting at 8.9% per year.

GAO report from March 2007 confirms we are in the midst of Peak Oil or will be before we can completely re-tool transportation.

For current information on energy review Energy Information Agency, the Association for the Study of Peak Oil and The Oil Drum. Cost for planning and building the disaster.

The October edition of Oilwatch Monthly can be downloaded at this weblink (PDF, 1.48 MB, 21 pp).

- CNBC: Matt Simmons, Nov 2, 2007

- CNBC: T Boon Pickens, Oct 18, 2007

- Bloomberg: Matt Simmons, Feb 1, 2007

- GAO Peak Oil Report. See charts below, Peak Crude in May 2005 and Peak all liquids June 2006

- Peak Oil Survival

- Total’s CEO, Financial Times, Oct 31, 2007 “The world’s capacity to produce oil will fall well short of official forecasts, the chief executive of Total warned on Wednesday. In an unusually stark prediction for the head of one of the world’s biggest oil companies, Christophe de Margerie, CEO of the French group, said it would be difficult to reach even 100m barrels a day.”

- Connecticut Legislature

- Electrical Grid is vulnerable. Design life of transformers is 40 years, average age is 40 years. Lifeboats, Feed-in Tariffs are critically important.

- Brutal Facts

- Supply Chain Management

- ABC Peak Oil

- Peak Minerals

- Pentagon Study

- Synapses and details

- End of Oil

- Oil Experts on Need

- Lack of Political Will

7. Food Distribution System is at Risk

With Peak Oil we are facing the catastrophic failure of the food distribution system.

- Farmers are unprepared for unstable fuel prices.

- Ethanol is building a false and unsustainable false farm economy.

- Most people do not know how to grow a substantial part of their food needs.

- Zoning laws prohibit food growth in suburbia.

Between 2002 and 2007 there has been a five-fold increase in the price of oil. That trend will continue until the food distribution system collapses. It is necessary to re-tool transportation before the crisis. The risks are indicated by food miles study.

9. On 29th October 2008 at The London Stock Exchange, eight leading UK companies launched a report, The Oil Crunch: Securing the UK’s energy future, warning that a peak in cheap, easily available oil production is likely to hit by 2013, posing a grave risk to the UK and world economy. The warning comes from a broad spectrum of industry (Arup, FirstGroup, Foster + Partners, Scottish and Southern Energy, Solarcentury, Stagecoach Group, Virgin Group, Yahoo), known as The Peak Oil Group.Link

10. US Army view on Peak Oil

11. German Military on Peak Oil

12. Bloomington, IN on Peak Oil

13. Hill Report of Themodynamics collapse of energy

- Hill Group Report and other summary of it

- Reference

National Geographics, https://www.nationalgeographic.com/environment/article/the-arab-oil-embargo-a-crisis-that-saved-us