Law of Supply and Demand

June 2025, EIA reported Peak Fracking. The oil-powered economy is ending:

- EIA report June 10, 2025, this updated their April warning of US Peak Fracking in 2027 and “Production to fall rapidly from 2030 through 2050“

- OilPrice.com: EIA Calls Peak Shale as Drilling Activity Declines

- Bloomberg: Shale Drillers in Permian Basin Face Up to the Prospect of Peak Output

- Forbes: Peak Oil In America: ‘Drill, Baby, Drill’ May Be Hitting A Wall

- Wall Street Journal: U.S. Drillers Say Peak Shale Has Arrived

- Dallas Federal Reserve survey of oil companies cited comment: “Shale core exhaustion and inventory concerns are mainstream and well-documented issues. Shale will likely tip over in five years, and U.S. production will be down 20 to 30 percent quickly. When it does—this feels like watching the steam roller scene in Austin Powers. Oil prices in the late 2020s will be something to behold.”

Dr. Deming: “Change is not required. Survival is not mandatory.”

Metrics: Replace GDP with Disposable Energy

Disposable Energy is much energy people can buy with their take-home-pay.

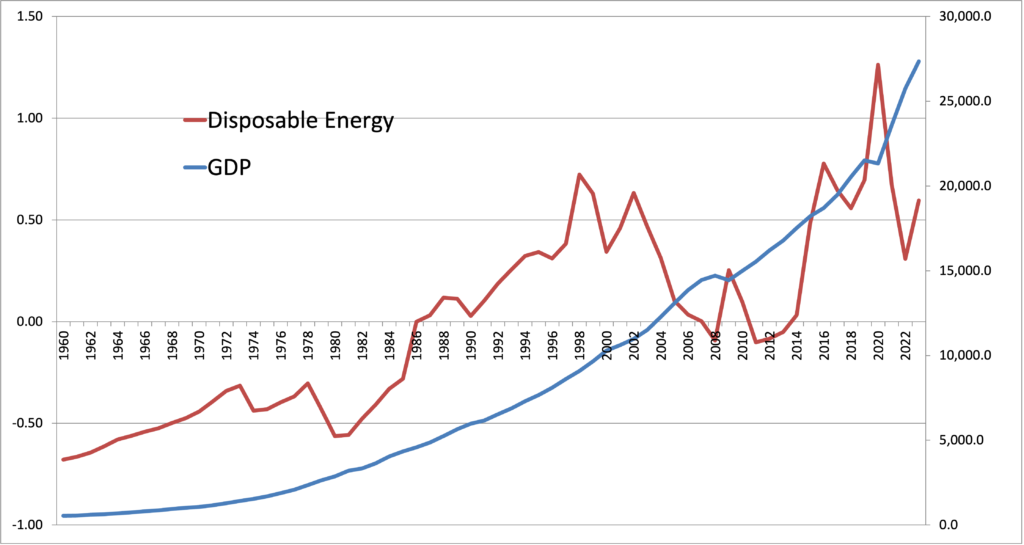

This is a simple version based on how much gasoline people could buy with their take-home-pay, normalized to 1986. Disposable Energy is compared with GDP. Note GDP barely registered the 1973 Oil Embargo, 1979 Iran Crisis, and 2008 Great Recession. Disposable Energy began warning of the 2008 crisis in 1998.

The economy is like a flywheel. Affordable energy and labor are inputs that build momentum. Debt burdens, rising energy costs, taxes drag on the momentum.

Disposable Energy is a forward-looking metric of how much labor can be purchased to apply energy to pursue happiness. In contrast, GDP is backward-looking and confused by governments money printing and debt spending.

Unemployment follows increasing energy costs.

Recession/depression follows increasing energy costs.

Dallas Federal Reserve warning on jumps in energy prices, a replay of 2008.

Monday, October 21, 2013