Paychecks and Oil

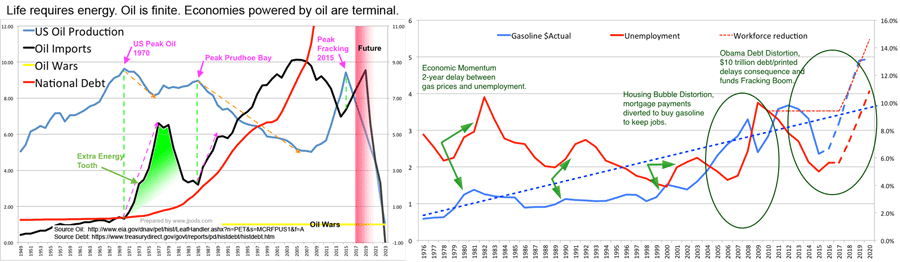

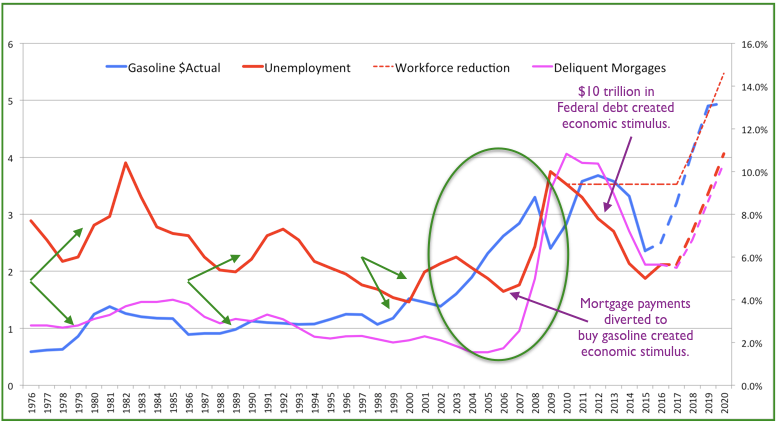

Unemployment is highly correlated with gas prices 18 months earlier. The long decline in US Oil Production

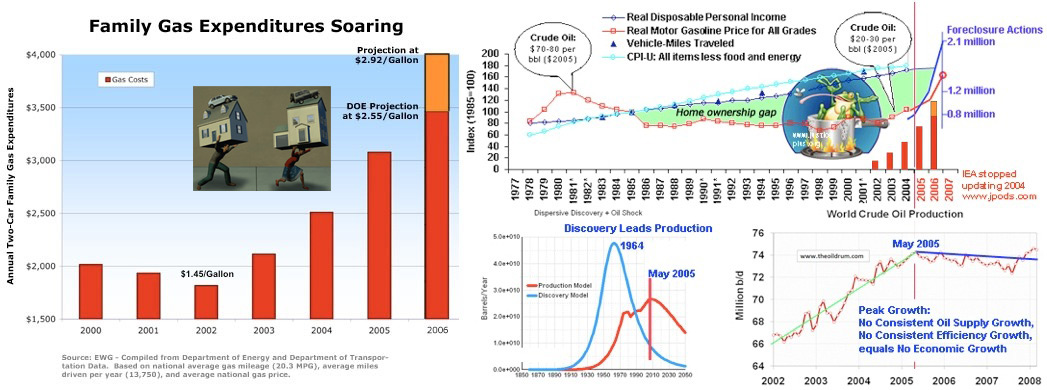

Bill James, of JPods used the following set of graphs in briefing Senate and campaign staffs for McCain and Obama in July 2008. With the exception of Bud McFarlane (former National Security Advisor), the staffs stated that current policies could manage the foreclosure issue. The left graph illustrates that rising gas prices were taking over $2,000 per year of family disposable income. The top right is a DOE graph (since removed) showing the spread between Disposable Income and energy prices.

The dark blue line is steadily increasing disposable income. The red line is oil prices. The gap in the 1990’s allowed people to risk their life’s savings to buy a house. Since oil supplies stopped growing in May 2005, prices shot up to squeeze more and more people into foreclosure.

DOE stopped updating this graph in 2004. I added the foreclosure, loss of disposable income graphs, and frog in a pot of cool water on a fire for the briefing. The bottom right graphs shows Peak Oil Discoverty in 1964 and World Peak Conventional Oil in 2005.

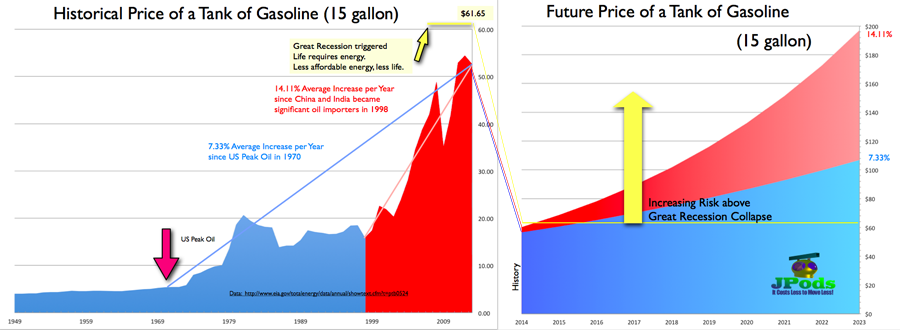

The Law of Supply and Demand requires that as supply decreased prices will increase to curtail demand. World oil production is in plateau (flat supply) and world population (demand) is increasing.

As gasoline prices increased families, especially those with bad credit loans that drove to qualify, were forced to choose between buying gas to keep their jobs or lose their jobs by paying their mortgage. As they fell behind a few payments, they gave up on even trying to keep their homes.

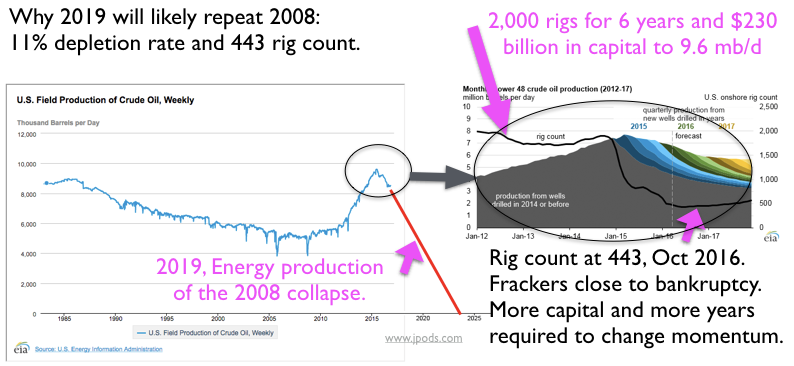

US oil supply is decreasing at the rate of 11% per year since Peak Fracking in June 2015. Between 2010 and 2015 2,000 drilling rigs were in the field. Over this period, US oil production increase 4.5 million barrels per day (mb/d). In Dec 2014, P&E (Production and Exploration) companies began to go bankrupt and the rig count has dropped to 443 (Oct 2016). US oil supply began its decline. To reverse this decline will require $500 billion to bail out the current bankruptcies and fund fielding those rigs.

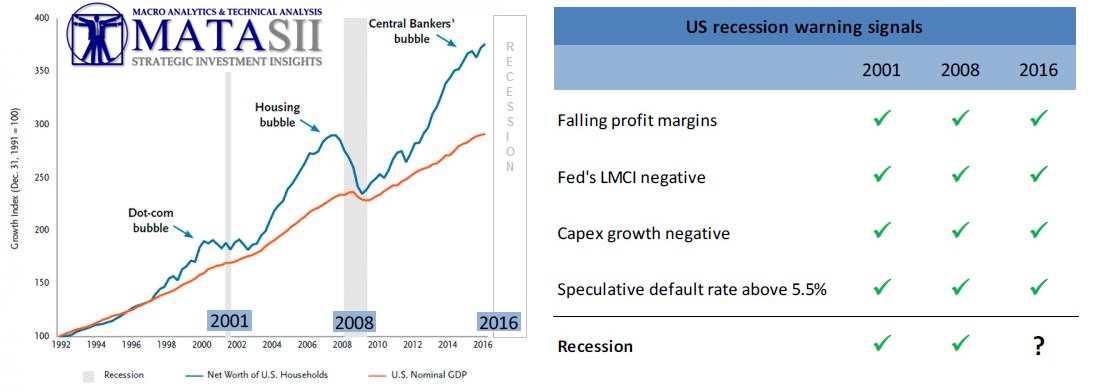

Currently, lifting the Iran Embargo has increased the world supply of oil. The US production decline has been compensated for by increasing foreign oil purchases with printed money. At some point, the ability to buy foreign oil with debt will collapse. Decreasing supply will force gasoline prices radically higher. The events of Sept 2008 will replay with Central Bank Debt replacing SubPrime.

At the current 11% per year decline in US oil production, the crisis of 2008 will repeat by 2019.